developers

The smart way to raise funds in real estate

The smart way to raise funds in real estate

BENEFITS & FEATURES

Financing has never been smarter

Developers have many reasons to choose Yeldo.

FINANCING HAS NEVER BEEN SMARTER

YELDO provides an easy solution, which connects you to new professional investors and manages them digitally.

DIVERSIFY YOUR INVESTMENTS AND SCALE-UP

By acquiring third-party investors you can devote your own capital to a higher number of investments.

TWO BRAINS ARE BETTER THAN ONE

Yeldo will connect you with a large network of professional investors and provide a dedicated team to help you reach your goals.

Fast financing

Financing has never been faster

From project submission to fundraising in less than two months

Start

Request financing

Submit your proposal. Our team will get in contact with you to discuss the opportunity in further detail.

one week

Indicative offer

Our team will promptly run a preliminary due diligence on your case and, if appropriate, will provide you with an initial indicative offer.

three weeks

Due diligence

If an agreement is reached, a termsheet containing key commercial points is signed and the complete due diligence process starts.

four weeks

Fundraising

Upon successful due diligence and approval by our external advisors, professional investors will have the chance to access the opportunity and invest in it.

Performance

How much capital do you need?

We support Real Estate developers by offering easy access to alternative financing thanks to tailor-made financing solutions and a network of real estate investors.

Total project size

EUR

up to 100M

Yeldo investment size

EUR

up to 25M

Investment duration

Months

up to 48

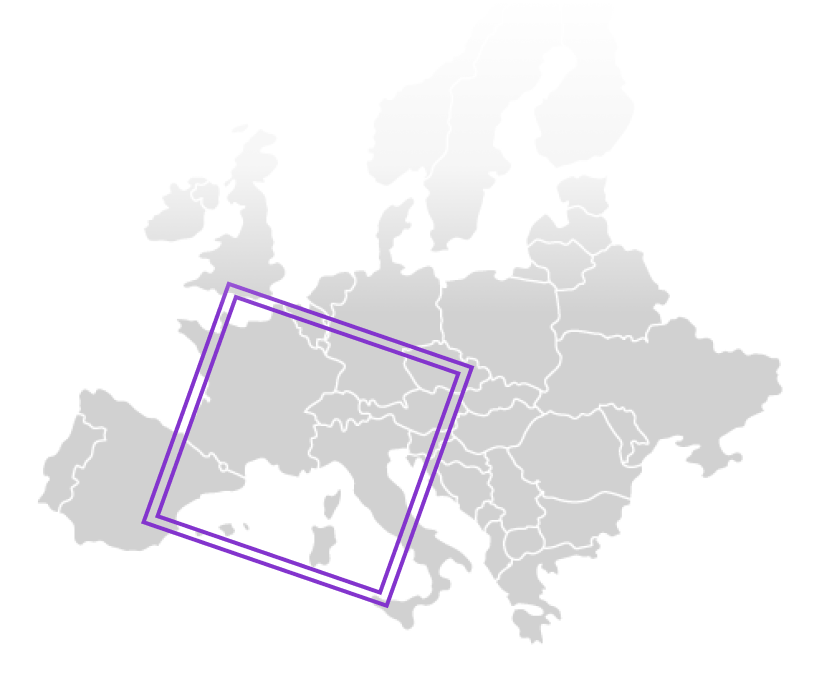

Geographies

Off market private real estate deals

Our investment focus lies in Switzerland, Italy, Spain and Portugal, geographies where we have a solid local presence and strong ties with real estate developers, equity investors and institutional asset managers.

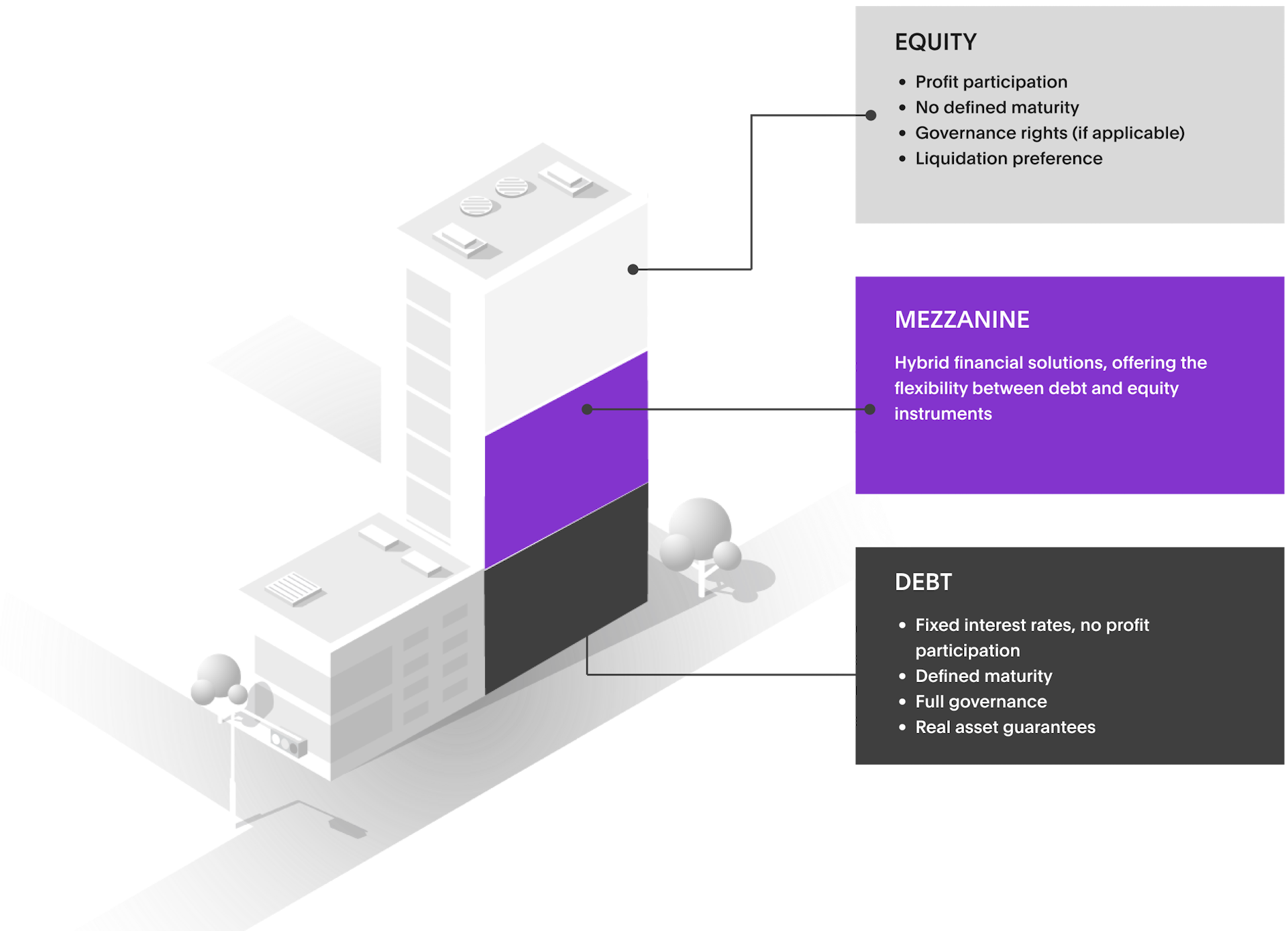

debt or equity

Are you looking for debt or equity?

Asset classes and destinations

What type of investment opportunity do you plan to offer?

We select assets from ground up developments to operating Core and Core Plus properties with a wide range of intended uses