10%+

Annual Target Return

Every 6 months

Redemptions

Open Ended

Duration

EUR 125,000

Min Investment Ticket

Real estate private debt fund

Get instant diversification via YELDO Real Estate Private Debt Fund

YELDO Real Estate Private Debt Fund

Add diversification with our open-ended strategy

Discover our open-ended Fund, targeting appealing risk-adjusted returns in Real Estate Private Debt while allowing diversification and redemptions every 6 months

10%+

Annual Target Return

Every 6 months

Redemptions

Open Ended

Duration

EUR 125,000

Min Investment Ticket

why real estate private debt

A compelling market momentum

European Real Estate is living a period of market dislocation, offering once-in-a-lifetime risk-adjusted investment opportunities:

Funding gap: regulatory pressures on traditional lenders continue to enlarge the "funding gap", today estimated at ~EUR 200 bn

Refinancing wall: as existing debt matures, rising interest costs create difficulties, generating appealing refinancing deals

Interest rates: high interest rates allow for opportunities to lend on high quality underlying, at lower LTVs, while achieving double digit returns

Benefits

Exclusive benefits granted to Fund investors

Redemption windows

Option to redeem your investment bi-annually after initial lock-up period of 24 months

Priority access to single deals

Fund investors will benefit from priority position in the allocation of YELDO single deals

Hyper diversification

Fund will subscribe a large number of relatively small single positions (from EUR 0.5 up to EUR 10m)

Full transparency

Investors will be able digitally access fund’s info such as single positions subscribed, live project updates and quarterly reporting

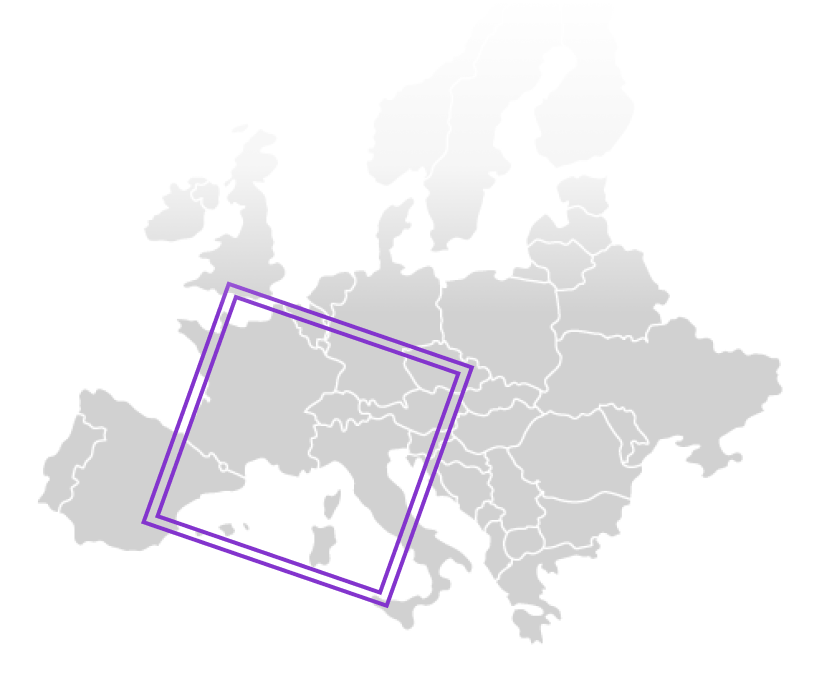

SELECTED GEOGRAPHIES

Key target geographies

Our investment focus lies in Europe and Switzerland, prioritizing stable economic areas where we have proprietary deal flow and deep market knowledge

PROTECTED POSITIONS IN RESILIENT ASSET CLASSES

Prime residential and hospitality projects

The fund focuses on resilient asset classes such as Prime Residential, Hospitality and Logistics Real Estate, negotiating strong sets of guarantees and collaterals for each position.